Bitcoin prices over the years

Bitcoin has been a hot topic in the world of finance for years, with its price fluctuating dramatically over time. To gain a better understanding of Bitcoin prices over the years, it is important to explore various articles that delve into this topic. Below are three articles that provide valuable insights into the historical price trends of Bitcoin.

Exploring the Volatility of Bitcoin Prices Over the Past Decade

Over the past decade, the cryptocurrency market has experienced significant fluctuations in prices, with Bitcoin being at the forefront of these changes. Bitcoin, the first and most well-known digital currency, has seen its value soar to unprecedented heights, only to plummet just as quickly. This volatility has left many investors and analysts wondering about the underlying factors driving these price swings.

One of the key drivers of Bitcoin's volatility is its limited supply. With only 21 million Bitcoins set to ever exist, any increase in demand can lead to a sharp rise in prices, while any decrease can result in a steep decline. Additionally, the lack of regulation in the cryptocurrency market has also contributed to the wild price swings, as news events and market sentiment can have a significant impact on prices.

Furthermore, the decentralized nature of Bitcoin means that it is not tied to any government or central bank, making it susceptible to external factors such as geopolitical events and regulatory changes. This lack of oversight has made Bitcoin particularly vulnerable to market manipulation and speculation, further exacerbating its volatility.

Overall, understanding the volatility of Bitcoin prices over the past decade is crucial for investors, policymakers, and anyone interested in the future of digital currencies. By delving into the factors driving these fluctuations, we can gain valuable insights into the potential risks and rewards

Analyzing the Factors Influencing Bitcoin Price Movements

Bitcoin, the leading cryptocurrency in the world, has been making headlines for its volatile price movements. Investors and traders are constantly trying to understand the factors that influence the price of this digital asset. Several key factors play a role in determining the price of Bitcoin, including market demand, supply, regulation, investor sentiment, and macroeconomic trends.

Market demand is one of the primary drivers of Bitcoin price movements. As more people become interested in investing in cryptocurrencies, the demand for Bitcoin increases, leading to higher prices. Supply also plays a crucial role in determining the price of Bitcoin. With a limited supply of 21 million coins, scarcity is a significant factor in driving up the price of this digital asset.

Regulation is another key factor that influences Bitcoin price movements. Government regulations and policies can have a significant impact on the price of Bitcoin. Positive regulatory developments, such as the approval of Bitcoin exchange-traded funds (ETFs), can lead to a surge in Bitcoin prices.

Investor sentiment is also an important factor in determining the price of Bitcoin. Positive news and developments in the cryptocurrency space can lead to increased investor confidence, driving up prices. Conversely, negative news can lead to a decrease in prices.

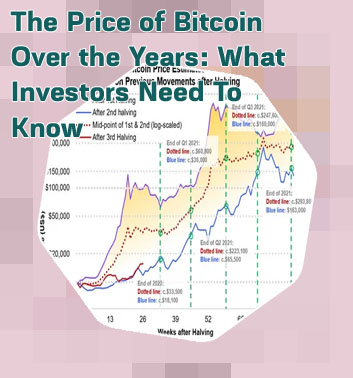

A Comprehensive Guide to Understanding Bitcoin Price Charts

Today we have the privilege of talking about the intricacies of Bitcoin price charts with a seasoned expert in the field. Bitcoin price charts are essential tools for anyone looking to understand the movements of the cryptocurrency market, and our expert is here to shed some light on the subject.

According to our expert, Bitcoin price charts are not just simple graphs showing the price of Bitcoin over time. They are sophisticated tools that can help traders analyze trends, identify patterns, and make informed decisions about buying or selling Bitcoin. By studying these charts, traders can gain valuable insights into the market sentiment and make predictions about future price movements.

Our expert emphasizes the importance of understanding different types of price charts, such as line charts, candlestick charts, and bar charts. Each type of chart provides unique information about the price of Bitcoin and can be used in different ways to make trading decisions.

In conclusion, mastering the art of reading Bitcoin price charts is crucial for anyone looking to navigate the volatile world of cryptocurrency trading. By understanding the intricacies of these charts, traders can make more informed decisions and increase their chances of success in the market.

This article is important for anyone interested in understanding the complexities of Bitcoin price charts and using them to make informed trading decisions.